Cyber insurance is a type of insurance that provides coverage for losses related to cyber attacks and other digital threats. This type of insurance can help businesses protect against the potential costs of a cyber attack, such as financial losses, reputational damage, legal liabilities, and disruption to business operations.

One of the key ways that cyber insurance can protect businesses is by providing financial coverage for the costs associated with a cyber attack. This can include the costs of hiring experts to investigate and respond to the attack, the costs of restoring or replacing damaged systems and data, and the costs of providing support to affected customers. For example, if a company’s systems are disrupted by a ransomware attack, cyber insurance can provide coverage for the costs of hiring a cybersecurity firm to investigate the attack, decrypt the company’s data, and restore its systems.

Cyber insurance can also provide coverage for the costs of legal proceedings and potential financial penalties that may arise as a result of a cyber attack. For example, if a company is found to have failed to adequately protect sensitive customer information, it may face legal action and potential fines. Cyber insurance can provide coverage for the costs of defending against these legal claims, as well as any potential financial penalties.

In addition to providing financial protection, cyber insurance can also help businesses recover from a cyber attack by providing access to a range of support services. This can include access to experts who can help businesses assess their cyber risks and implement effective security measures, as well as access to legal and PR support to help businesses manage the aftermath of an attack. For example, if a company’s systems are disrupted by a cyber attack, it may need assistance in restoring its systems and data, as well as support in managing communications with customers and other stakeholders. Cyber insurance can provide access to these support services, helping businesses to recover from an attack and resume normal operations.

Overall, the role of cyber insurance is to help businesses protect against the potential costs of a cyber attack, and to support businesses in their efforts to recover from an attack and resume normal operations. By providing financial protection and access to support services, cyber insurance can help businesses mitigate the risks and costs associated with a cyber attack, and can play a valuable role in helping businesses protect against these threats.

Recent Cyber Security topics In Singapore:

Hacking

4th January 2023

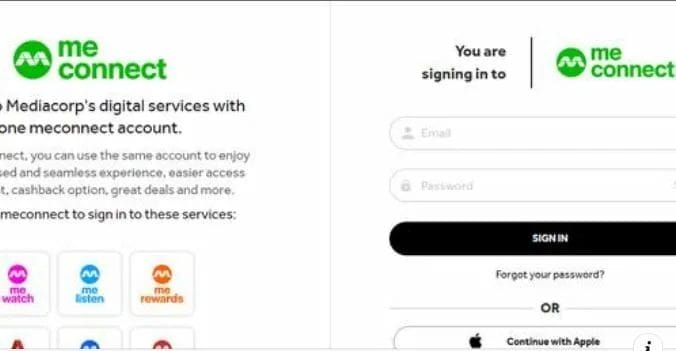

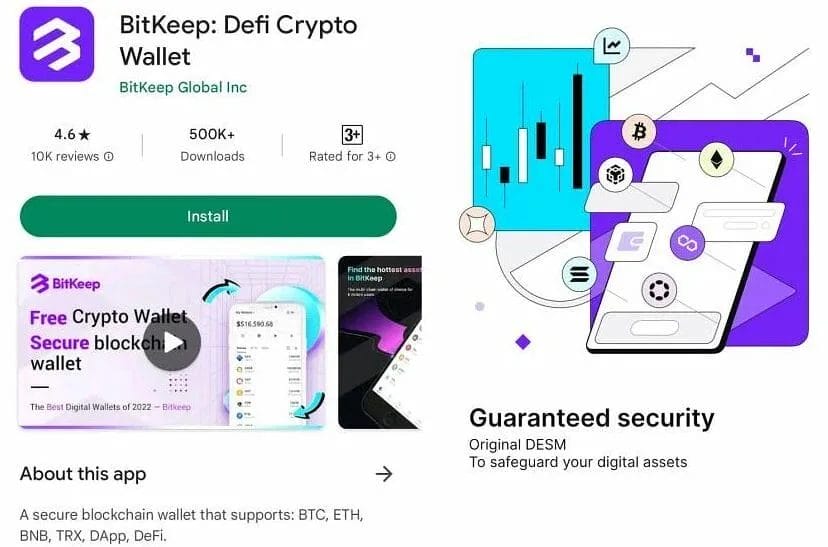

Singapore-based crypto firm hit by Dec 26 hack, more than $10 million lost

Fined

21st December 2022

RedMart fined $72,000 after addresses, partial credit card info of nearly 900,000 people leaked

Source: straitstimes.com

Recent Cyber Security topics In Singapore:

Source: straitstimes.com

Recent PDPC Commission’s Decisions:

Breach of the Protection Obligation by CPR Vision Management Pte Ltd Nature of Breach: Protection Decision: Directions Published Date: 10 Feb 2023 Breach of the Protection Obligation by RedMart Nature of Breach: Consent, Notification, Purpose Limitation Decision: No further action Published Date: 10 Feb 2023

Source: pdpc.gov.sg